In this tutorial, we are showing how borrowing WBTC to buy liquid staking tokens can increase the...

A Guide to Leveraged Staking on 1delta

1delta is a protocol that allows traders to use lending liquidity for trading. Traders can create or close margin positions (borrow-swap-supply or reversed) in a single transaction.

With borrow delegation, the protocol does not require a user to create smart wallets, as the positions are swapped in a similar experience to DEXs and DEX aggregators. Since the funds are directly held by the underlying lending protocol like Aave, and not the 1delta protocol, the smart contract risk is significantly reduced.

What is Leveraged Staking?

One of the currently interesting use cases of decentralized margin trading is leveraged staking, using liquid staking tokens like MATICX or stMATIC. It is a special method to increase staking yields by depositing a wrapped staking asset to a lender and borrowing a highly correlated asset against it to increase the exposure to the staking yield—while still maintaining the same risk profile.

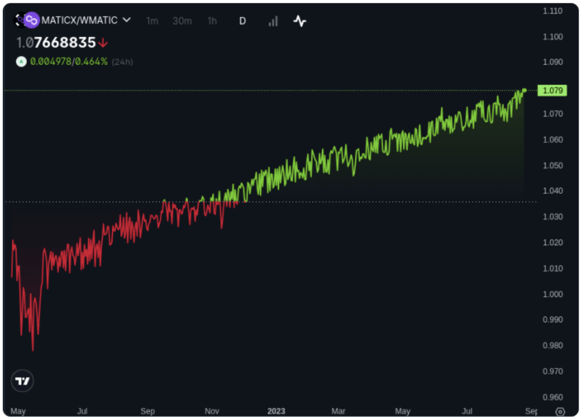

This will incur borrowing cost, however, the staking yield by the liquid staking tokens is not directly visible in the lending platform, as the yield is not paid out but accrued directly in the token, which becomes visible by looking at the price chart.

The price charts of MATICX quoted in MATIC shows a steady price increase caused by the auto-compounding of its interest.

The price charts of MATICX quoted in MATIC shows a steady price increase caused by the auto-compounding of its interest.

The Arbitrage Opportunity

At the time of this writing, MATICX has an APY of 4.8% and WMATIC a borrow rate of 4.6% with a 0.3% incentive—resulting in a net borrow rate of 4.3%.

As we can borrow WMATIC cheaper (4.3%) than the yield paid by MATICX (4.8%), there is an arbitrage opportunity of 0.5%. To leverage this arbitrage opportunity, we want to borrow as much as WMATIC as possible to buy MATICX. With Aave’s E-Mode, we can achieve a leverage of about 10x.

The yield on this position would be 10 x 4.8% − 9 x 4.3% = 9.3%, almost a 100% increase over the original 4.8%.

In the next section, we guide you through the steps to build such a position using 1delta.

Leveraged Staking on 1delta

Step 1: Deposit

First, we have to deposit the desired collateral into the lending protocol by clicking the Deposit button in the bottom section under Positions. If you already have some deposits in Aave, you can click the Deposit button next to your assets:

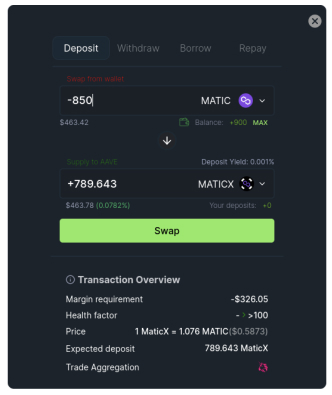

In our test wallet, we are holding MATIC but no MATICX. We can deposit the target currency MATICX by choosing an arbitrary asset from our wallet, in our case MATIC, which will automatically get swapped at the best rates and deposited into Aave:

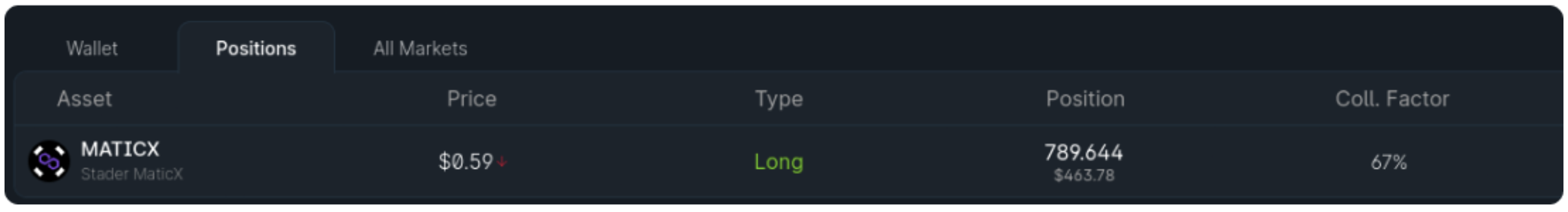

The deposit becomes visible in the Positions tab:

The MATICX sit now in the Aave protocol.

Step 2: Turn on E-Mode

As Aave only allows us to borrow 67% (collateral factor) against MATICX for all assets, we can use their E-Mode for MATIC-correlated assets to increase the collateralization factor and the resulting leverage.

The “E-Mode” is available in the Account Panel:

Step 3: Build the Position

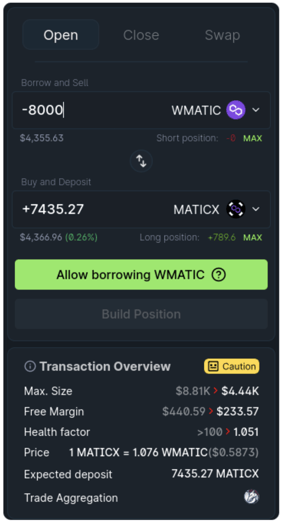

With our deposit of 789 MATICX and the E-Mode turned on, we can now borrow 8,000 WMATIC to buy 7435.27 MATICX. This equals a leverage of around 10x.

We an open a position by selecting the Open tab in the main input panel:

- In the upper input field, we then enter 8000 and select WMATIC as the currency.

- In the lower input field, we select the MATICX as the currency, and the amount gets calculated automatically.

As indicated in the Transaction Overview at the bottom, 1inch provides the best swap price. To be able to swap, we have to grant the 1delta Swap Router permission to borrow on your behalf. Clicking on the Allow borrowing WMATIC will trigger an approval transaction in your wallet.

As indicated in the Transaction Overview at the bottom, 1inch provides the best swap price. To be able to swap, we have to grant the 1delta Swap Router permission to borrow on your behalf. Clicking on the Allow borrowing WMATIC will trigger an approval transaction in your wallet.

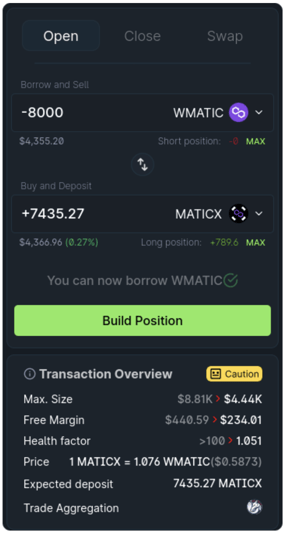

Once approved, we can execute the trade by clicking on Build Position:

Account Panel

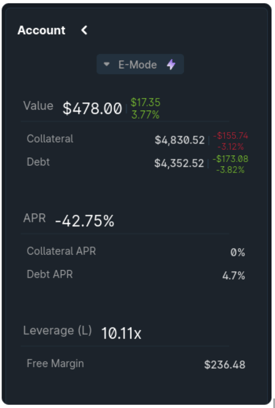

The Account Panel now shows a leverage of 10.11x with a total position value (Collateral) of 4,830.52. The NAV (Net Asset Value) of $478.00 remains the value of the 800 MATIC used for the initial deposit:

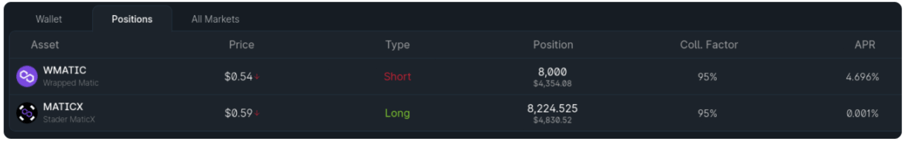

The bottom table shows under Positions our long and short position:

Positions in Aave

As an alternative to the 1delta interface, you can see and manage your positions directly in Aave’s official app. This shows that the funds are held inside the Aave protocol and users are not dependent on 1delta to retrieve their funds.

Summary

We used the 1delta platform to create a leveraged staking position to maximize our income which previously required the creation of vaults, smart wallets or manual looping through multiple borrow-swap-deposit cycles.

The position can be created quickly and with a minimum set of transactions—allowing users to instantly benefit market opportunities present on lenders like Aave.

Closing or changing the position is even simpler. Stay tuned for our next piece that dives into managing your portfolio through 1delta.

Disclaimer: The content provided in this blog post is for informational purposes only and should not be construed as financial or investment advice. All actions based on this information are taken at your own risk. Past performance is not indicative of future results. Always consult with a professional before making investment decisions. 1delta or its affiliates accept no liability for any direct or indirect losses resulting from the use of this information.