1delta is a protocol that allows traders to use lending liquidity for trading. Traders can create...

Leveraged Staking: Maximizing Yield with 1delta

In this tutorial, we are showing how borrowing WBTC to buy liquid staking tokens can increase the yield due to the favorable borrow rates of WBTC (generally <1%) and achieve yields of >10% with a 3x leverage only. However, since the assets are not 100% correlated, there is a risk of getting liquidated. To mitigate that risk, we use a leverage of less than 2.5x to add a margin of safety.

What is Leveraged Staking?

One of the currently interesting use cases of decentralized margin trading is leveraged staking, using liquid staking tokens like MATICX or stMATIC. It is a special method to increase staking yields. This is done by using such a staking token as collateral and borrowing a somewhat correlated asset against it, selling it against the staking token to increase the overall position. By using a correlated asset, the trader is not as exposed to the underlying staking token while holding the increased position.

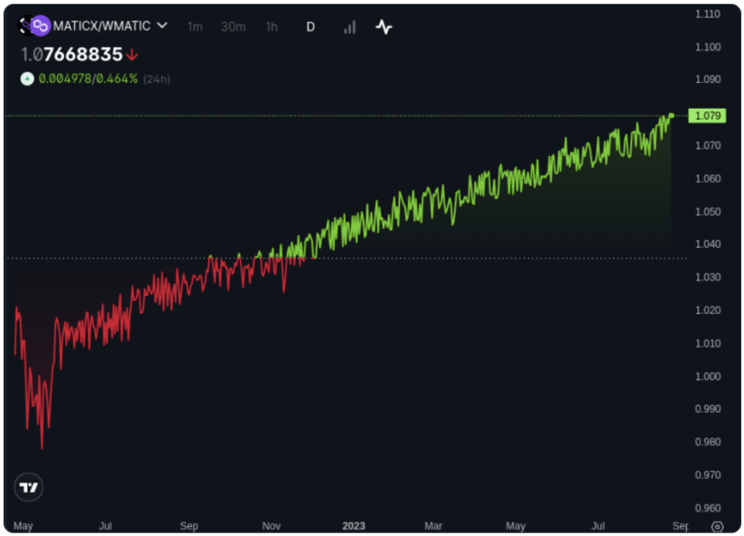

There is a cost of borrowing the assets, however, there is a yield by the liquid staking tokens which is not directly visible in the lending platform, as the yield is not paid out but accrued directly in the token, which becomes visible by looking at the price chart.

The price charts of MATICX quoted in MATIC shows a steady price increase caused by the auto-compounding of its interest:

Increasing the Yield

At the time of this writing, MATICX has an APY of 4.8% and WBTC a borrow rate of 0.3%.

To leverage this opportunity, we want to borrow a reasonable amount in WBTC that leaves a solid margin of safety to buy MATICX. With a collateral factor (= “liquidation threshold” in Aave’s terms) of 67%, the maximum leverage would be:

1 / ( 1 - collateralFactor ) = 1 / ( 1 - 0.67 ) = 3x

A reasonable margin of safety would be provided at a leverage of about 2.5x.

The yield on this position would be 2.5 x 4.8% − 1.5 x 0.3% = 11.5%, a more than 100% increase over the original 4.8%.

In the next section, we guide you through the steps to build such a position using 1delta.

Building a Leveraged Staking Position on 1delta

Step 1: Connect Wallet

As a first step, make sure your wallet is connected:

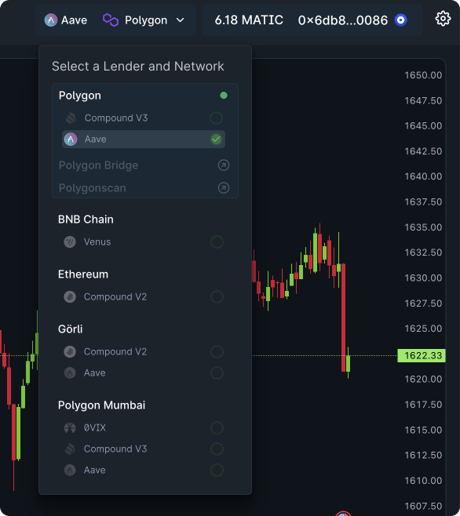

Step 2: Select Network

For the strategy used in this tutorial, select Aave on Polygon.

Step 3: Deposit

First, we have to deposit the desired collateral into the lending protocol by clicking the Deposit button in the bottom section under Positions. If you already have some deposits in Aave, you can click the Deposit button next to your assets.

The deposit function can be triggered in multiple ways. The main panel button and the emphasized Deposit in the bottom table both open a modal that allows you to deposit funds into Aave:

In our test wallet, we are holding MATIC but no MATICX. We can deposit the target currency MATICX by choosing an arbitrary asset from our wallet, in our case MATIC, which will automatically get swapped at the best rates and deposited into Aave:

The deposit becomes visible in the Positions tab. The asset sits now in the Aave protocol:

Step 4: Build the Position

With our deposit of 789 MATICX, we can now borrow WBTC at a relatively low rate and use it to buy MATICX to increase our MATIXC position.

On the Open tab in the main panel, we have to select WBTC in the top panel as the borrow asset and MATICX in the bottom panel as the collateral asset.

To get a leverage of around 2.5x on our ~740 MATICX deposit, we buy an additional 1,000 MATICX to increase our position, leading to a leverage of (1,000 + 740) / 740 = 2.35x.

The corresponding optimal trade will be determined and the calculated value will be inserted into the other field, similar to DEXs like Uniswap:

The panel now requests us to allow borrowing WBTC. This is required so that the 1delta router can borrow WBTC on our behalf.

Once approved, we can execute the trade by clicking on Build Position.

As indicated in the Transaction Overview at the bottom, 1inch provides the best swap price. Pressing the button Build Position will execute the trade.

Final State

Value

The Account Panel now shows a total position value (Collateral) of $1,077.67.

Value shows the net asset value of $458.90, which is the value of the 800 MATIC used for the initial deposit.

APR

Our APR is displayed as -0.32%, however, since the staking yields are not included in this calculation, our actual yield on our collateral is 4.8%, and, as shown in a previous calculation, our total yield is 11.5%.

Leverage

The box at the bottom shows our leverage and free margin, which is our remaining borrow capacity, serving as our margin of safety to prevent liquidation.

The bottom table shows under Positions our long and short position:

Positions in Aave

You can see and manage your positions directly in Aave’s official app. This shows that the funds are held inside the Aave protocol and are not dependent on 1delta to retrieve your funds.

Summary

We used the 1delta platform to create a leveraged staking position to maximize our income which previously required the creation of vaults, smart wallets or manual looping through multiple borrow-swap-deposit cycles.

The position can be created quickly and with a minimum set of transactions—allowing users to instantly benefit market opportunities present on money markets like Aave.

Closing or changing the position is even simpler. Stay tuned for our next piece that dives into managing your portfolio through 1delta!

Disclaimer: The content provided in this blog post is for informational purposes only and should not be construed as financial or investment advice. All actions based on this information are taken at your own risk. Past performance is not indicative of future results. Always consult with a professional before making investment decisions. 1delta or its affiliates accept no liability for any direct or indirect losses resulting from the use of this information.