Over the last decade, crypto finance was largely dominated by centralized institutions,...

The 1delta Protocol: Powering the Future of Crypto Trading

At 1delta, we are on a mission to accelerate the transition to DeFi and foster a robust decentralized economy. Centralized exchanges pose numerous risks, some even systemic ones, and to replace them, a more advanced trading protocol is required. The current DeFi landscape doesn’t offer a single trading protocol with advanced features that allow margin trading—one of the key issues the 1delta protocol is addressing.

Spot Trading in DeFi

In the current DeFi landscape, traders have access to deep liquidity, making the execution of spot swaps a seamless process. A significant development in this area has been the recent shift in trading volume from centralized exchanges (CEX) to decentralized exchanges (DEX). This change is a reflection of a growing mistrust in centralized entities within the crypto space.

However, the present bear market brings challenges, particularly for those seeking to adopt trading strategies that are not correlated with the market. Options for positioning oneself effectively are limited, especially given that popular protocols like Uniswap only support spot trading.

Synthetics & Perpetual Futures

Platforms offering perpetual futures have emerged as alternatives to classic CEXs, giving traders the opportunity to open highly leveraged positions. However, this advantage comes at the price of exorbitant fees. This often prevents traders from holding positions for more than just a few days, an important consideration given that bear markets can persist for months if not years.

The speculative nature of such platforms may cater to a certain type of risk-seeking trader, but they are not necessarily suitable for more seasoned or conservative asset managers, given the cost of the position.

Conflict of Interest

Perp platforms also have a liquidity pool which takes the other side when a trader opens a position. This creates a conflict of interest, as the platform is trading against its users, as a user’s profit means a loss for the platform and the other way around. This issue gets pronounced under certain market conditions. In a scenario like a bull market, where the market primarily moves up and everyone goes long, the platform can lose a lot of money very quickly and risk bankruptcy.

Liquidations

Liquidations are done in a centralized manner and the penalty for being liquidated is extraordinarily high:

- Most perpetual platforms will take the entire collateral if a liquidation is triggered despite a large margin of safety.

- This is in general not a fair practice particularly due to the fact that a liquidation is executed by the platform operator and due to the synthetic nature of the position, the platform is at no risk of creating a huge price impact when liquidating a position.

Last but not least, the use case of high leverage is primarily gambling as nobody can predict short-term market movements without insider information and the high fees result in a net loss for almost all traders over time when the high fees are included.

A Gambling Substitute

Gambling is prohibited in most jurisdictions. Many financial institutions in the past have designed gambling services in the form of financial services. The regulator is aware of this issue and prohibits certain financial products like binary options or high leverage, especially for retail. Consequently, FTX had to reduce its maximum leverage due to regulatory pressure. Even though it's decentralized, this business model is viewed as unsustainable and is plagued with numerous challenges, limitations, and ethical concerns.

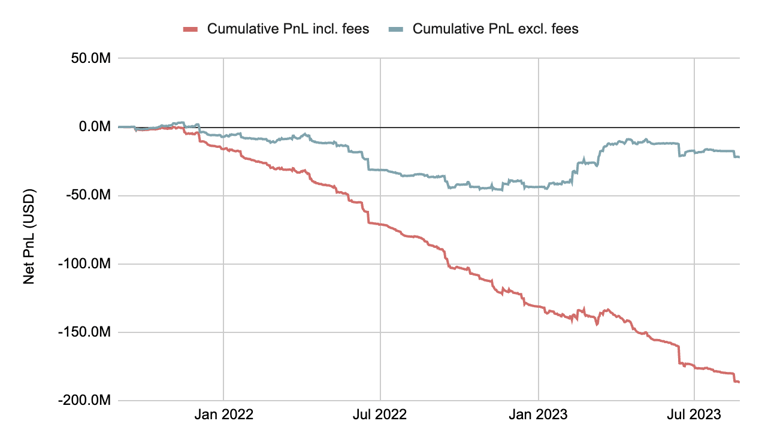

GMX Traders Are Losing

In a casino, the house always wins. This shouldn't necessarily be the case in finance. The cumulative PnL without fees (blue line) doesn't show such a bad picture. Once the exorbitant platform fees are factored in, it's becoming clear that the users are losing big.

Manual Leverage Through DeFi Lenders

A third option for traders seeking leverage is utilizing the deep liquidity offered by on-chain lenders like Aave, which are known for their low borrowing rates. These protocols operate on an over-collateralized basis, meaning that if a user deposits $1,000, they can borrow only approximately $800, or 80% of the collateral value. However, these borrowed funds can be sold and re-deposited, allowing the user to borrow another 80% of the new deposit, and this process can be repeated to reach a maximum safe leverage of around 4x.

While this approach presents an attractive leverage structure, it is not without its disadvantages. The manual creation of margin positions through such a multi-step process can be error-prone due to the nature of on-chain transactions and their associated delays. Transactions in the blockchain require time to complete, and at each step of the leveraging process, traders are exposed to the risk of liquidation until the additional deposit is finalized.

If the market moves against the trader, their account gets flagged for liquidation. As a result, everyone can liquidate a position with an incentive premium. This open-market mechanism leads to efficient liquidations.

Thus, while on-chain lenders like Aave offer specific advantages in terms of costs and liquidations, the complexity and risks involved in manually creating margin positions may present substantial challenges, particularly for those unfamiliar with the intricacies of on-chain transactions.

1delta: A Decentralized Brokerage Protocol

Core Mechanics

On a high-level, the 1delta protocol aggregates liquidity from DEXs and lending protocols to provide spot trading and build margin positions. The protocol is using the best swap routes and aggregators and applies an additional optimization and safety logic.

1delta is poised to change the way we are conducting decentralized trading, utilizing flash loans and flash swaps to compose leverage margin positions without requiring the trader to navigate cumbersome borrow-swap-deposit cycles.

The 1delta protocol leverages DeFi tools like flash loans and borrow delegation to build high leverage margin positions on lenders like Aave. This process allows for the direct creation of positions in the selected wallet. Consequently, these positions can be accessed through all accessible DeFi frontends.

1delta's usage of flash swaps—a variation of flash loans where the repayment is done in a different currency—further enhances the process, allowing the entire transaction to be conducted without paying flash loan fees or relying on specific flash loan providers.

The composable nature of 1delta’s system provides traders with the flexibility to use our smart order routing or their preferred DEX aggregator to compose and unwind margin positions with any lender. This innovative approach offers a streamlined and efficient experience for all types of traders, positioning 1delta as a new household name in the DeFi landscape.

Access to DeFi’s $10B+ of Liquidity at the Best Rates

1delta offers a flexible approach to DeFi lending, allowing users to choose any lender to find the best borrow and deposit conditions. Along with 1delta's smart order router, the platform is compatible with any swap aggregator, as such, the provider of best swap rates can be used at all times. This adaptability enables users to integrate their own infrastructure directly into 1delta, creating a personalized trading environment that suits individual needs and market conditions with maximum performance and redundancy.

1delta is simplifying margin trading in DeFi like never before. Creating and unwinding leveraged positions is now a simple step. Even sophisticated strategies like leveraged staking become accessible to a wider audience. This ease of access opens doors to innovative financial strategies for seasoned traders and newcomers alike.

Future Developments

Liquidation Saver

Traders will soon get the option to utilize stop-loss orders to avert liquidations on the lending-protocol level and avoid additional fees. This shift in control empowers individuals with more strategic management of their positions, minimizing risks and enhancing their ability to respond to rapid market changes.

Higher Leverage

The 1delta protocol offers a comprehensive trading protocol that is narrowing the gap to centralized exchanges, which need to be eliminated due to their system risk for Web3. As blockchains and DeFi protocols evolve, new features will become possible that will eventually lead to a better overall value proposition for crypto trading platforms and its users.1delta is poised to bridge the gap between leverages found on perpetual platforms and those offered by on-chain lenders by introducing liquidity pools that enable higher leverages. This innovation will empower traders to access leverages of up to 15x, all while retaining the robust market depth associated with on-chain lending. The integration of these excess pools signifies a groundbreaking step, aligning advanced trading capabilities with the intrinsic advantages of on-chain mechanisms at attractive borrow rates.

Conclusion

The 1delta protocol offers a comprehensive trading protocol that is narrowing the gap to centralized exchanges, which need to be eliminated due to their system risk for Web3. As blockchains and DeFi protocols evolve, new features will become possible that will eventually lead to a better overall value proposition for crypto trading platforms and its users.

If you are looking to power your trading platform or are a crypto trader, check out the 1delta app or get in touch with the community for information.